With the approval by Congress last year of the new SSS Charter of 2018 or Republic Act 11199, the SSS contribution table has also significantly changed, showing higher Monthly Salary Credit (MSC) and, consequently, higher monthly contributions from SSS members as well.

Under the new charter, SSS members are now categorized into three, with varying Monthly Salary Credit (MSC) and monthly contributions depending on the category in which they belong:

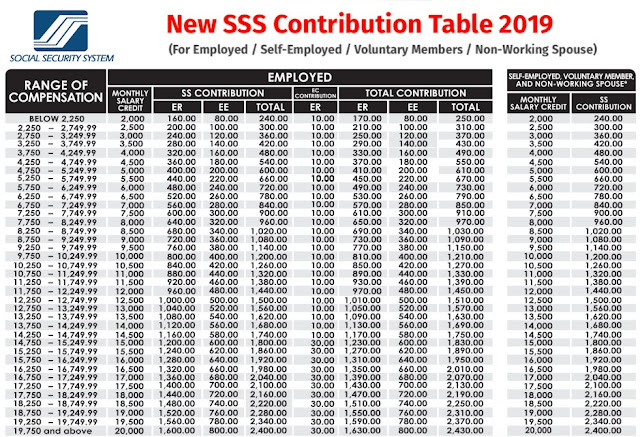

Here’s the latest version of the SSS Monthly Contribution Table 2019, which will be used to compute the monthly premiums to be paid by all Social Security System (SSS) members, including new required members OFW and kasambahay, starting last April 2019.

The Monthly Salary Credit simply refers to the “compensation base for contributions and benefits related to the total earnings for the month.” Under the new SSS law, the highest Monthly Salary Credit or MSC is P20,000 — up from the previous maximum MSC of P16,000 — which means the member’s premium contribution will now be based on this P20,000 MSC.

The MSC is important because this becomes the basis, not just for the amount of SSS contribution that the employee has to pay, but also for the computation of benefits that the SSS members may receive. According to former SSS Commissioner Emmanuel Dooc in a Philippine Star interview: “As we increase the coverable income, the benefits also increase because this is the basis for computation of SSS benefits.”

For the first category (Employed, Self-Employed, Voluntary Member, and Non-Working Spouse), the applicable minimum Monthly Salary Credit (MSC) has been increased from P1,000 to P2,000, while the maximum MSC has also been increased from P16,000 to P20,000.

For the second category (Household Employers and Kasambahay), the minimum Monthly Salary Credit is P1,000 while the maximum MSC is now P20,000.

For OFWs, the minimum Monthly Salary Credit is P8,000 while the maximum MSC is P20,000.

Effective April 2019, the new SSS contribution rate is now 12% of the Monthly Salary Credit (MSC) — an additional 1% increase from the previous 11% contribution. Two-thirds of the contribution will be shouldered by the Employer, while the Member-Employee will shoulder the remaining one-third.

The newly approved SSS law (RA 11199) provides for mandatory coverage for all OFW — meaning, all Overseas Filipino Workers are now required to pay monthly SSS contributions depending on the salary they are receiving.

Based on the Implementing Rules and Regulations (IRR), an OFW will not be allowed to leave the country unless he or she has paid the required contribution. Thus, payment of full SSS contributions is now a pre-requisite before an OFW can leave to work abroad.

Under the IRR of the new SSS law, the contribution rate and the Monthly Salary Credit (MSC) will increase effective January every year from 2019 to 2025.

The contribution rate will rise from 12% of the MSC in 2019 to 15% of the MSC by the year 2025. The maximum Monthly Salary Credit will also rise, from P20,000 in 2019 to P35,000 in 2025.

Land-based OFWs, meanwhile, are currently considered “self-employed” members since current labor agreements do not allow for the same set-up as that of sea-based OFWs. As such, land-based OWs will be solely required to pay the SSS contribution in full prior to leaving for abroad.

This means, they themselves will need to shoulder the “Employer Share” of the SSS contribution. The amount of total SSS contribution of a land-based OFW working in a country with no bilateral labor agreement is shown in the right-most columns of Table 3 below. (Also see sample computation below in the section “Sample Computations of SSS Contributions.”)

However, the law has mandated the Department of Foreign Affairs (DFA) and the Department of Labor and Employment (DOLE) to negotiate bilateral labor agreements in countries where there are OFWS to see if the deduction of employer share may be enforced by the country.

For salaried employees, the amount of the EmployER share and EmployEE share can be seen in the “Total Contribution” columns.

The Employer pays the amount in the “Total Contribution – ER” column, while the Employee pays the amount in the “Total Contribution – EE” column. The amount to be remitted to SSS by the employer is the sum of the two, and can be seen in the “Total Contribution – Total” column.

If an Employee earning P15,000 salary per month, the Employer Share is P1,230.00 while the Employee Share is P600.00 (based on Table No.1 above). This means, the employee will be deducted the amount of P600.00 from his or her monthly salary, while the employer must remit to SSS the full contribution of P1,830.00 (computed as P1,230.00 + P600.00).

For Self-Employed (SE), Voluntary Member (VM), or Non-Working Spouse (NWS), the only relevant column is the “SE/VM/NWS – SS Contribution” column. There is no Employer share since they are either not working or working but with no other employer but themselves. In this case, they will be the one to shoulder the entire contribution.

For Voluntary Member earning gross compensation of P5,000 per month, based on the SSS table No. 1 above, your SS contribution will be P600.00 per month.

The increase in monthly SSS contributions is expected to help reduce the pension fund’s unfunded liability. “Unfunded liabilities” are future obligations of the SSS in which no funds have been set aside.

Back in 2014, the SSS could only cover obligations and liabilities up to year 2039. This meant that after 2039, the SSS would have been unable to provide pension and benefits anymore to its members. However, in 2017, Pres. Rodrigo Duterte approved a proposal to increase the monthly pension received by SSS retirees by P2,000 per month. The first additional P1,000 monthly pension increase was paid beginning 2018 and the next P1,000 increase was paid beginning 2019.

This move, although benefited more than 2.3 million SSS pensioners, cut short the life of SSS by more than ten (10) years. Because of the pension hike, the life of the SSS was cut short to year 2026, meaning, by 2026 the SSS would have been unable to pay its obligations and members might no longer receive monthly pension or other benefits by then.

Thus, the additional increase in monthly contributions was necessary in a bid to prolong the life of the SSS. According to the SSS, the approval of the Social Security Act of 2018 extended the life the fund until the year 2045, “on the back of the implementation of the contribution increase and adjustment in minimum and maximum salary credits under the newly-signed law.”

We just hope the SSS management will be prudent and competent enough to manage these funds from this point onwards. Otherwise, the happy retirement of millions of Filipinos banking on the SSS will be put at risk.

Under the new charter, SSS members are now categorized into three, with varying Monthly Salary Credit (MSC) and monthly contributions depending on the category in which they belong:

- Employed, Self-Employed, Voluntary Member, and Non-Working Spouse;

- Household Employers and Kasambahay; and

- Overseas Filipino Workers (OFW).

Here’s the latest version of the SSS Monthly Contribution Table 2019, which will be used to compute the monthly premiums to be paid by all Social Security System (SSS) members, including new required members OFW and kasambahay, starting last April 2019.

The Monthly Salary Credit simply refers to the “compensation base for contributions and benefits related to the total earnings for the month.” Under the new SSS law, the highest Monthly Salary Credit or MSC is P20,000 — up from the previous maximum MSC of P16,000 — which means the member’s premium contribution will now be based on this P20,000 MSC.

The MSC is important because this becomes the basis, not just for the amount of SSS contribution that the employee has to pay, but also for the computation of benefits that the SSS members may receive. According to former SSS Commissioner Emmanuel Dooc in a Philippine Star interview: “As we increase the coverable income, the benefits also increase because this is the basis for computation of SSS benefits.”

For the first category (Employed, Self-Employed, Voluntary Member, and Non-Working Spouse), the applicable minimum Monthly Salary Credit (MSC) has been increased from P1,000 to P2,000, while the maximum MSC has also been increased from P16,000 to P20,000.

For the second category (Household Employers and Kasambahay), the minimum Monthly Salary Credit is P1,000 while the maximum MSC is now P20,000.

For OFWs, the minimum Monthly Salary Credit is P8,000 while the maximum MSC is P20,000.

Effective April 2019, the new SSS contribution rate is now 12% of the Monthly Salary Credit (MSC) — an additional 1% increase from the previous 11% contribution. Two-thirds of the contribution will be shouldered by the Employer, while the Member-Employee will shoulder the remaining one-third.

The newly approved SSS law (RA 11199) provides for mandatory coverage for all OFW — meaning, all Overseas Filipino Workers are now required to pay monthly SSS contributions depending on the salary they are receiving.

Based on the Implementing Rules and Regulations (IRR), an OFW will not be allowed to leave the country unless he or she has paid the required contribution. Thus, payment of full SSS contributions is now a pre-requisite before an OFW can leave to work abroad.

Under the IRR of the new SSS law, the contribution rate and the Monthly Salary Credit (MSC) will increase effective January every year from 2019 to 2025.

The contribution rate will rise from 12% of the MSC in 2019 to 15% of the MSC by the year 2025. The maximum Monthly Salary Credit will also rise, from P20,000 in 2019 to P35,000 in 2025.

Land-based OFWs, meanwhile, are currently considered “self-employed” members since current labor agreements do not allow for the same set-up as that of sea-based OFWs. As such, land-based OWs will be solely required to pay the SSS contribution in full prior to leaving for abroad.

This means, they themselves will need to shoulder the “Employer Share” of the SSS contribution. The amount of total SSS contribution of a land-based OFW working in a country with no bilateral labor agreement is shown in the right-most columns of Table 3 below. (Also see sample computation below in the section “Sample Computations of SSS Contributions.”)

However, the law has mandated the Department of Foreign Affairs (DFA) and the Department of Labor and Employment (DOLE) to negotiate bilateral labor agreements in countries where there are OFWS to see if the deduction of employer share may be enforced by the country.

For salaried employees, the amount of the EmployER share and EmployEE share can be seen in the “Total Contribution” columns.

The Employer pays the amount in the “Total Contribution – ER” column, while the Employee pays the amount in the “Total Contribution – EE” column. The amount to be remitted to SSS by the employer is the sum of the two, and can be seen in the “Total Contribution – Total” column.

If an Employee earning P15,000 salary per month, the Employer Share is P1,230.00 while the Employee Share is P600.00 (based on Table No.1 above). This means, the employee will be deducted the amount of P600.00 from his or her monthly salary, while the employer must remit to SSS the full contribution of P1,830.00 (computed as P1,230.00 + P600.00).

For Self-Employed (SE), Voluntary Member (VM), or Non-Working Spouse (NWS), the only relevant column is the “SE/VM/NWS – SS Contribution” column. There is no Employer share since they are either not working or working but with no other employer but themselves. In this case, they will be the one to shoulder the entire contribution.

For Voluntary Member earning gross compensation of P5,000 per month, based on the SSS table No. 1 above, your SS contribution will be P600.00 per month.

The increase in monthly SSS contributions is expected to help reduce the pension fund’s unfunded liability. “Unfunded liabilities” are future obligations of the SSS in which no funds have been set aside.

Back in 2014, the SSS could only cover obligations and liabilities up to year 2039. This meant that after 2039, the SSS would have been unable to provide pension and benefits anymore to its members. However, in 2017, Pres. Rodrigo Duterte approved a proposal to increase the monthly pension received by SSS retirees by P2,000 per month. The first additional P1,000 monthly pension increase was paid beginning 2018 and the next P1,000 increase was paid beginning 2019.

This move, although benefited more than 2.3 million SSS pensioners, cut short the life of SSS by more than ten (10) years. Because of the pension hike, the life of the SSS was cut short to year 2026, meaning, by 2026 the SSS would have been unable to pay its obligations and members might no longer receive monthly pension or other benefits by then.

Thus, the additional increase in monthly contributions was necessary in a bid to prolong the life of the SSS. According to the SSS, the approval of the Social Security Act of 2018 extended the life the fund until the year 2045, “on the back of the implementation of the contribution increase and adjustment in minimum and maximum salary credits under the newly-signed law.”

We just hope the SSS management will be prudent and competent enough to manage these funds from this point onwards. Otherwise, the happy retirement of millions of Filipinos banking on the SSS will be put at risk.

2 comments

Click here for commentsHOW I GOT MY EX HUSBAND BACK WITH THE HELP OF REAL AND EFFECTIVE SPELL FROM DR Osasu My name is Olivia Jayden, I never thought I will smile again, My husband left me with two kids for one year, All effort to bring him back failed I thought I'm not going to see him again not until I met a lady called Jesse who told me about a spell caster called Dr. Osasu , She gave me his email address and mobile number and I contacted him and he assured me that within 48hours my husband will come back to me, In less than 48hours my husband came back started begging for forgiveness saying it is the devils work, so I'm still surprise till now about this miracle,i couldn't conceive but as soon as the spell was cast,i became pregnant and gave birth to my third child,if you need any assistance from him you can contact him via:email: drosasu25@gmail.com Or WhatsApp or call him now:

Reply+2347064365391 . Dr.Osasu also cures: 1. HIV / AIDS 2. HERPES 1/2 3. CANCER 4. ALS (Lou Gehrig’s disease) 5. Hepatitis B

Hello everyone , I was totally broken when the love of my life left me it was so hard for me and I almost gave up if not for a friend who directed me to a very good and powerful man called Dr Ralph who helped me bring back the love of my life and now he treat me with so much love and care. I don’t know what kind of problem you are passing through but with what he did for me I know he can help you. So try and talk to him on WhatsApp on: +2347037816417 Or email at: Ralphspellsolution@gmail.com. He has a permanent solution to any type of problems such as: Lottery Spell, Love Spell, Power Spell, Psychic reading, Success Spell, Cure of any sickness, Pregnancy Spell, Marriage Spell,Job Spell, Protection Spell,Win court Case Spell, Luck Spell and many more.

ReplyConversionConversion EmoticonEmoticon